|

|

|---|

At a Post-Crypto-Crash Art Basel, Tech-Based Art Is Trying Hard to Blend in and Look Like… Painting?

Buyers are more cautious, even as buzz about A.I. and blockchain continue in the background.

Where did all the crypto-art go?

After the big busts of 2022, seemingly everyone buying and selling at the uber-chic Swiss fair Art Basel has closed their digital wallets. The NFT-based art that shot onto the scene in 2021 was a notable absence from the stalls of all but a few of the 284 exhibitors this year. And Tezos, once the crypto-currency darling of the art world, was also absent as an official partner at the marquee Swiss fair (unsurprising, since it has lost 56 percent of its value year-over-year).

Given the uncertainty swirling in the art market in general (the Swiss have their own banking scandal on their hands as UBS, a major sponsor of Art Basel, sweeps in to take over Credit Suisse), can anyone really be blamed for a bit more caution? A sense of risk-aversion was felt among buyers here—and crypto is especially risky. And yet, perhaps now that the froth of speculation has gone, the blockchain experiments that remain are more sustainable and meaningful.

“What we’ve learned is that an art fair is not necessarily the best place to debut an NFT,” said one gallery director who had previously brought NFT-based works to this fair. “Transactions for them happen online, so if we do bring them it is to show them, not for a point-of-sale.”

AI Data Paintings by Refik Anadol were among the prominent projects incorporating artificial intelligence. NFT-based art was few and far between. (Installation view of Jeffrey Deitch’s. booth with Neural Paintings by Refik Anadol. Image: Stefan Altenburger.

In 2021, Kenny Schachter debuted NFT-based art for Art Basel with a special project at Galerie Nagel Draxler called “NFTism,” packing the booth with curious, confused, and excited onlookers. This year, he said he was not surprised by the sudden lack of crypto-art on the fair floor. “The crypto market crashed, so no one here wants anything to do with it,” he said, sitting inside the atrium of the fair with some friends. He rolled up his sleeve to show me his famous “NFT” tattoo, which he recently updated to add the word “post” above it.

“People here are so conservative, they want to have what their friends have,” Schachter added. “The art world has its finger up and the wind is blowing away from NFTs, especially with the onslaught of the SEC.” (U.S. regulators are currently knocking on the doors of big crypto exchanges such as Coinbase and Binance.) The fizzle of interest was felt already at Art Basel Miami Beach last fall, he noted. “There has been no change from December to June. As soon as things cool down, the art world will be back in no time.”

Galleries that had been quick to charge into the crypto space were taking a pause this year, including Galerie Nagel Draxler and Pace, the latter of which presented Jeff Koons’s first-ever NFT project, Jeff Koons: Moon Phases, last year. Now, both continue to work in the crypto space, but in the expanded fields beyond the Messeplatz (Pace is still active online and Nagel Draxler has a dedicated gallery called a Crypto Kiosk in Berlin that is presenting all kinds of works that engage with blockchain). In their Art Basel booths, paintings and sculptures and art historical classics dominate.

Kenny Schachter at the Crypto Kiosk at Nagel Draxler Gallery in Basel in 2021.

A spokesperson from Pace said they may consider presenting some works later in the week at Art Basel, but that depends on what gets changed out at the booth when sales close.

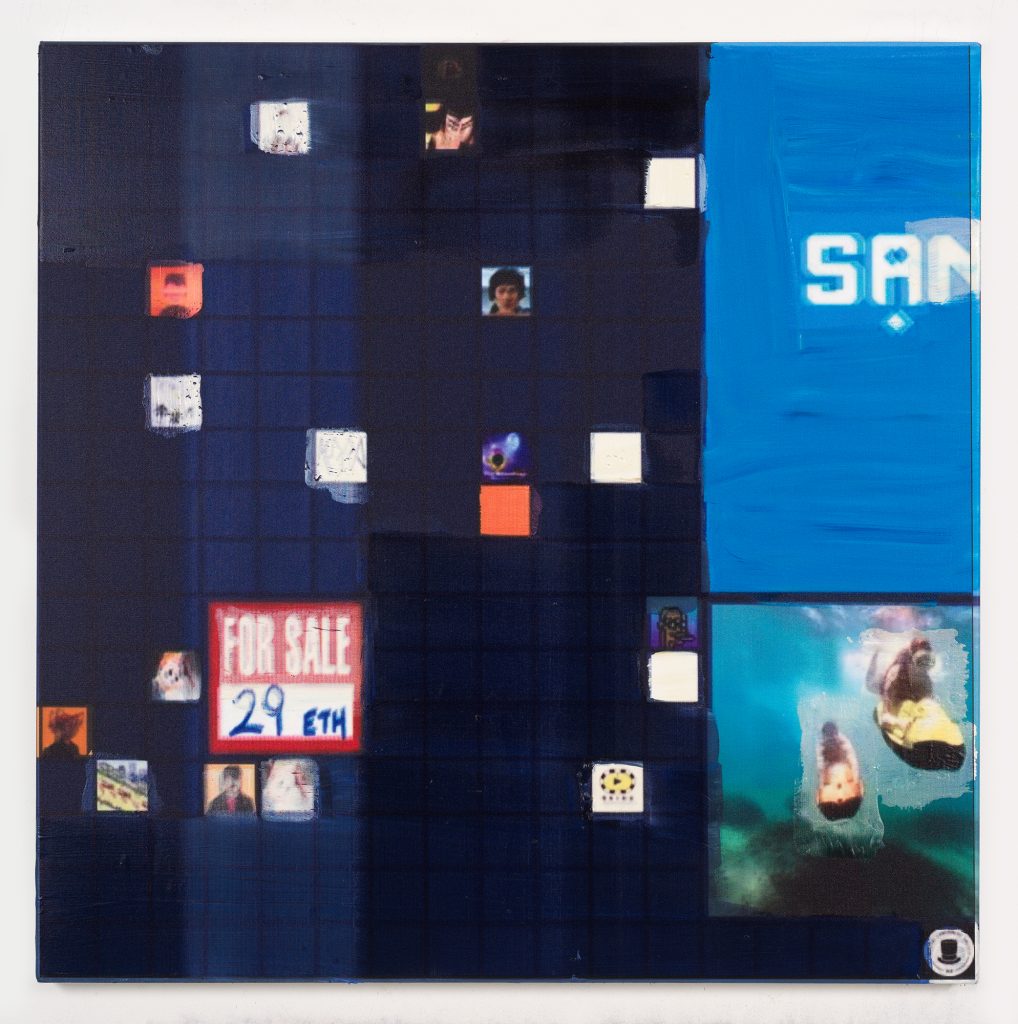

However, work that engaged NFTs was present in a few places, if you really looked. Simon Denny, who has long engaged with emergent technologies in his practice, was perhaps the only NFT-based work at the main art fair, and it was designed to blend in: His painting on view at Petzel, from the new “Metaverse Landscapes” series, appears on the surface like a traditional work on canvas featuring fragmented images. It was nestled next door to a massive, €1.65 million painting by Martin Kippenberger.

Denny’s work only reveals its full meaning when you notice that there are QR codes on its side, one of which shows you a piece of private property in the metaverse that the work is representing. Denny minted a bit of virtual real estate as an NFT that you get with the painting, conjuring questions about property ownership in virtual space. Still, the work cleverly borrows from landscape painting and classic conceptualism to make its point—crypto-art designed to give the art-historically inclined something to hold onto (literally).

Simon Denny’s Metaverse Landscape 8: The Sandbox Land (-196, 23) (2023). Oil on canvas, UV print, Ethereum paper wallet, dynamic ERC-721 NFT. Photo: Nick Ash. Courtesy: the artist

“People are looking for things secure in value and crypto and NFTs are quite insecure,” the artist told me. “This project addresses the viewers here because it is a painting first and speaks about art history. Plus, you do not need to be literate in crypto to buy it.” Of note: Implanted on the back of the painting is a chip with a crypto wallet so that whoever buys the piece may access the NFT without having to learn how to set one up. It seems to be a winning strategy. Denny’s work, which has a price tag of €30,000, was on reserve by 4 p.m. on preview day.

Meanwhile, galleries have made moves towards using the technology for actual concrete business strategies. Arcual, now an official partner of Art Basel, was set up near the champagne in the collectors’ lounge on the third floor, presenting talks and artworks. The company uses blockchain technology to create ownership chains that benefit both artists and dealers, hoping to change the way business as usual is done in the art market. They are creating NFTs for any and all works of art.

“I am a strong believer in what blockchain can bring to the industry, but I was always skeptical of the speculation we were seeing,” said Bernadine Bröcker Wieder from Arcual. “We want to focus on the art again.” She noted this current moment in crypto is less of a wild ride than 2021 when NFT-based art prices went soaring. “We follow some of the standards of what was set with the NFT boom, but have helped it evolve to work seamlessly in the art world within the way the art world already works.”

Phoebe Cummings at the Arcual Booth, Art Basel in Basel, 2023, photos by Gloria Soverini Photography.

The hot topic in tech has clearly moved on to artificial intelligence. Vast public anxiety looms over this field, and so art has felt a new sense of urgency to engage. Digital paintings by Refik Anadol, who was subject of a major exhibition at MoMA earlier this year, were front and center at Jeffrey Deitch’s booth—though the dealer was emphasizing how easy to understand they were in ordinary art terms.

“Our market is conventional,” said Jeffrey Deitch when asked about the appetite for collectors when it comes to digital art. “People are buying these works as ‘living paintings,'” he emphasized, a reference to the title of the ongoing series. Anadol’s triptych (on sale for $300,000) had a prominent space at the front wall of Deitch’s booth. Though still available at 4 p.m. on preview day, it had a seemingly ever-present cluster of VIPs in front of it.

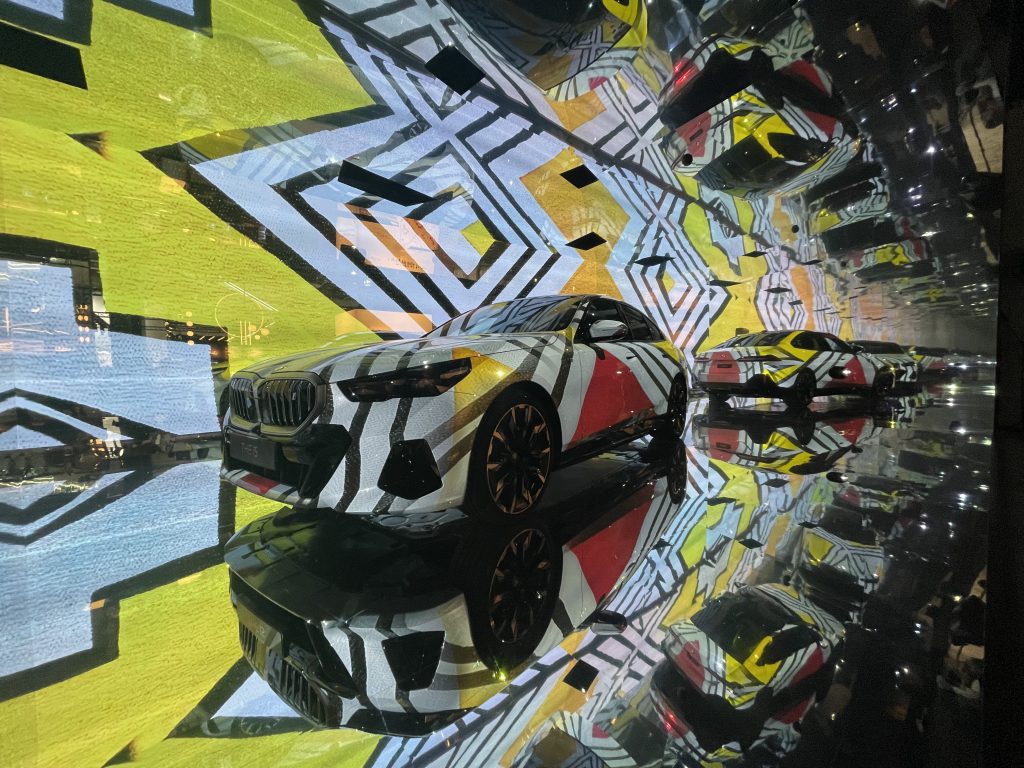

In the foyer of Unlimited, BMW’s annual art car this year brought a high-tech spin to artists who do not typically work in the digital space. The South African artist Esther Mahlangu’s boldly geometric abstract paintings were among those featured for a spectacular generative art piece.

The Electric AI Canvas at Art Basel in Basel 2023. An installation inspired by the new BMW i5. Featuring Esther Mahlangu, 2023. © BMW AG

Also inside the fair’s Unlimited section was a work by Croatian artist Tomo Savić-Gecan. Basically, what you saw there was a large screen explaining its own premise; the real show was throughout the fair, and could even be a joke about tech-based art trying to blend in with the environment and speak using the symbols people know.

For the piece, selected lights all around Art Basel were made to vary in intensity at certain times. These changes were governed by an algorithm, fed by data based on randomly selected art news articles which are analyzed in relation to the latest Art Market: An Art Basel and UBS Report.

The various locations of the piece are announced daily on the project website as well as on large screens situated at Unlimited and the booth of galerie Frank Elbaz. The public is invited to go to those locations and observe their surroundings—thereby becoming part of the performance themselves.

It’s a fun work. But even Elbaz’s reps noted the learning curve is steep for digitally engaged art in general. “It is a type of artwork that collectors are not familiar with, but it’s also ephemeral,” said a spokesperson from the Paris-based gallery. “You really do have to accompany collectors and educate them about the work, but also about conceptual art in general.” (There are two versions for sale, priced at €70,000 and €95,000.)

For now, the overall emphasis on painting-like objects seems telling. It may be that the recent spectacle of the crypto bubble has dampened appetites not just for crypto-art but for the more adventurous forms of tech art in general. Once the markets feel more sure of themselves, maybe more works similar to Savić-Gecan’s data-based environmental work, which feels as if it is relevant to changes that are sweeping across society as a whole, will make a more overt return to the art fair floor.

As for crypto-art, plenty of people are still betting that it is due for a comeback. “NFTs are revolutionary,” Schachter said. “It is here to stay. The dust just needs to settle.”

No comments:

Post a Comment