Art Market

What You Should Expect from an Art Advisor

Whether she’s working with established collectors who spend upwards of $5 million a year on blue-chip artists or newer buyers who are keen to get to know which emerging artists they should collect, Paris-based art advisor Laurence Dreyfus enjoys using her two decades’ experience in the art world to nudge her clients towards something just outside their comfort zone.

“Sometimes they buy it but they’re not 100 percent sure, but they trust me,” she said. “And after they look at it, they say, ‘Oh yes, you were right.’ It happens quite often, and [it’s] a great satisfaction.”

Art advisors offer a range of services, from simply educating new collectors and suggesting art for a new apartment, to providing access to hard-to-acquire artists and helping develop a philosophical foundation for a major collection. Fundamentally, an advisor uses her or his expertise to help a client make better, more informed purchases that will stand the test of time. So what should one expect when hiring an art advisor?

Education

Alex Glauber, a former assistant curator to the Lehman Brothers art collection (which was mostly liquidated during the 2008 financial crisis) who became an independent art advisor 10 years ago when he was just 25, also tries to encourage clients to consider works that they may not gravitate towards at first.

“It takes a certain degree of confidence to bring things into your home that you can’t fully understand or resolve in your mind,” he said. “But those are the things that tend to wear well.”

Glauber, who is based in New York, sees his role as two-fold: He provides what he calls “an aesthetic or intellectual education,” as well as an education about how the art market functions, explaining, for example, why the same artist might command different prices in a gallery sale versus an auction appearance.

Glauber wants his clients to have a solid grounding in the factors that go into an artwork’s price, and “how all those prices are determined…[how they] coexist,” he said.

“I educate them not to make them more conscious about how they spend their money, but to make them more confident transacting,” Glauber added. “So when we visit an art fair or a gallery, they can pull the trigger.”

Todd Levin, a longtime art advisor based in New York, said education should always be the first step, and one that must not be rushed. He tells aspiring art advisors they should expect to spend at least a few months working just on that, especially if the client is new to collecting.

“For the first three to six months, they’re going to be keeping their wallet shut,” he said. “Then after some education [has been] done, they start buying, and [are] hopefully going to be making fewer mistakes along the way.”

“Wall to wall” service

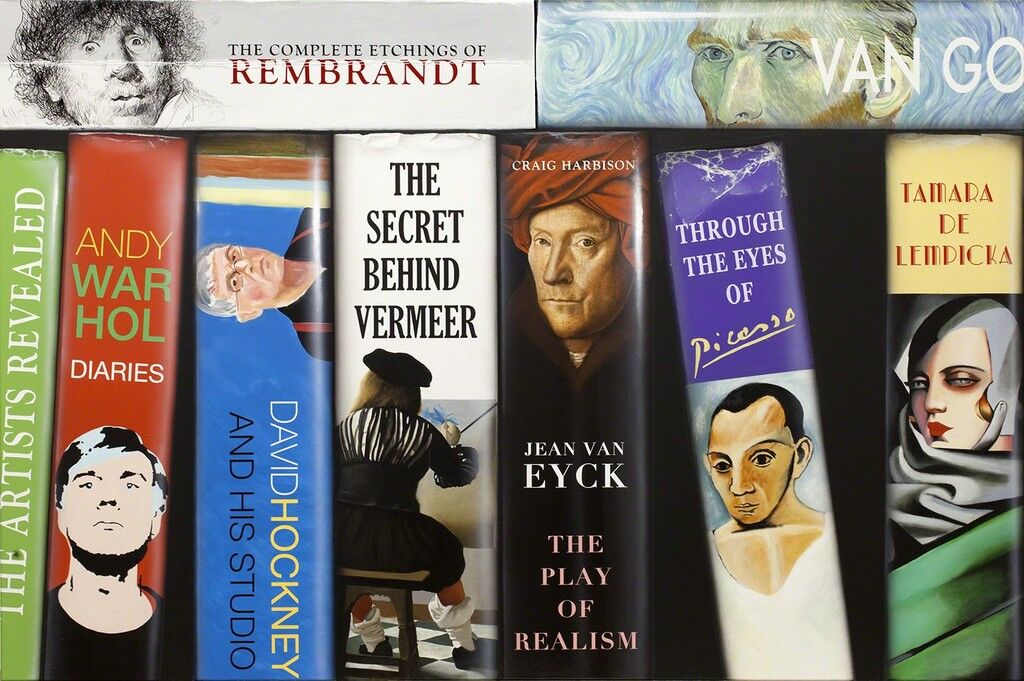

Glauber, like other art advisors, will often travel with certain clients to art fairs, museums, and galleries. Others hire him not just to help them select art, but to build out reference libraries full of art books, as well.

For clients who already have a collection, Glauber will typically start by inventorying the collection, entering the works in a database, and writing an analysis that highlights any themes or relationships he has detected among the works. Then he’ll “identify areas where [the collection] could be strengthened, further developed, or built out more dynamically,” he said.

For example, a client of his had unintentionally amassed a collection that included a fair amount of work by Chicago artists

and

, two members of the Hairy Who group. Glauber suggested adding work by other members, such as

and

, to add “another dimension to the collection by telling a more cogent story” of a movement.

and

, two members of the Hairy Who group. Glauber suggested adding work by other members, such as

and

, to add “another dimension to the collection by telling a more cogent story” of a movement.

Once they do start buying, Levin provides what he calls “wall to wall, nail to nail” service, meaning he will oversee the shipping, any custom crating that needs to be done, customs assistance, insurance questions, and installation in a client’s home, among other services that typically are needed.

Levin said an art advisor should also be able to recommend an expert for any conservation or restoration work that might be necessary, and have the capacity to evaluate a restoration or conservation report and weigh in. “If it’s a sculpture and they want it to be cleaned, perhaps it’s a situation where you don’t want to remove the patina because it’s going to damage the value of the work,” said Levin.

Sector-specific expertise

Levin said that level of expertise should come from an advisor’s deep knowledge about the time periods, movements, and media within which she or he works. “The advisor should be fully informed and aware of the types of work they’re selling,” he said, down to whether a layer of rust is best left on a sculpture or not, for example. “If not, they should not be dealing in that tranche of the market.”

Though he has been advising for over 30 years and has a broader-than-average range of art-historical periods under his belt, from antiquities to

to contemporary art, Levin is still keenly aware of his limits.

to contemporary art, Levin is still keenly aware of his limits.

“If someone want to buy green Chinese pottery, I’m not their guy,” he said. Instead, his responsibility as an advisor is to find the best green Chinese pottery expert he can for an interested client.

“One of the most important things is to know what you don’t know, and being willing and able to make those recommendations,” Levin said.

No conflicts of interest

Levin is also a board member of the Association of Professional Art Advisors (APAA), the only accrediting body for the industry in the United States. The APAA screens members and ensures they abide by its code of ethics and professional practice, which bars members from accepting “any remuneration for a sale in a manner that could create a conflict of interest, or even the appearance of a conflict interest, between the Member and his or her client.”

In other words, advisors should accept payment only from the client, and not be paid by a gallery or auction house or any other party that could compromise the advisor and cause her or him to act in any way contrary to the client’s best interest.

In Europe, Asia, and Latin America, it is common for advisors to also work as dealers, or maintain a small inventory of work they resell to clients. This means a conflict could arise if, say, a dealer was more interested in offloading a work for a profit than in ensuring the work was the right fit for the client. Advisors who run their business in that fashion won’t be a good fit for the APAA, said Levin, though the organization is seeing more interest from those regions.

A transparent fee structure

Even if an advisor does not have APAA accreditation, a client can still protect her or himself by asking a few key questions. First, clarify payment structures and compensation: How does the advisor run her business? Secondly, what services are provided for those fees? And lastly, can the advisor guarantee that she will be a fiduciary to the client alone and represent the client’s best interests?

The APAA outlines several common payment arrangements, including a retainer fee paid on a monthly or hourly basis, a full-time salary, a percentage-based fee contingent on the value of the works bought, or some combination of the above.

For works around $5 million or under, the advisor will usually make 10 percent of the transaction price, Levin said. Above that, the percentages can slide lower. When Glauber closes a sale, he prefers to have the gallery invoice the client directly to maintain as much transparency as possible, unless the client prefers to remain anonymous.

Dreyfus will often charge a bit extra for services including crating, shipping, and other logistical matters, because she employs a small team that helps her handle those issues. When Dreyfus spends a long time working with a client to educate her and bring her up to speed before the client buys anything, she’ll charge a retainer during that period, which not only compensates her for her time, but demonstrates to her that the client is serious about collecting.

Glauber said his optimal arrangement, especially at the outset, is a monthly retainer, which ensures his client never feels he’s going to be charged incrementally and always feels free to pick up the phone or send him an email.

“I never want a client to think twice about calling me or reaching out,” he said. “My job is to keep it fun and enjoyable, as collecting should be.”

Anna Louie Sussman

No comments:

Post a Comment