Author of The Art Market | 2017, Clare McAndrew. Courtesy of Art Basel.

Author of The Art Market | 2017, Clare McAndrew. Courtesy of Art Basel.

Art Basel and UBS released The Art Market | 2017 on Wednesday at Art Basel in Hong Kong. The report was prepared by longtime arts economist and founder of Arts Economics Clare McAndrew, whose research, previously for the TEFAF Report, has been a guidepost for the art market. Here are 11 of her key findings about the art market in 2016.

1.

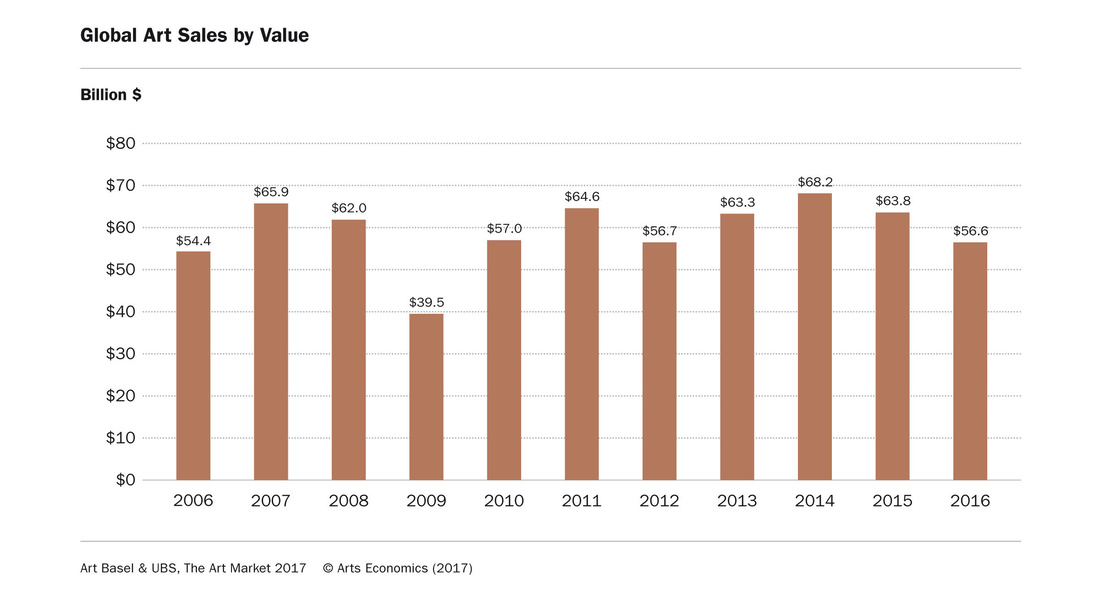

Overall sales for the global art market fell 11% in 2016, to $56.6 billion.

2.

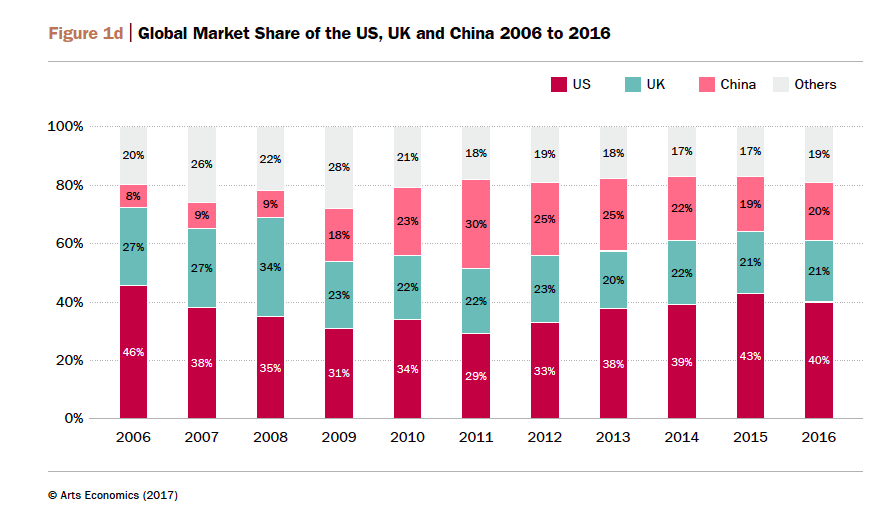

The U.S. remained the largest market for art, with a market share of 40%, down three percentage points from the prior year. The U.K. was second with a 21% share, with China breathing down its neck at 20%. Still, the U.S. suffered a 16% decline in sales in 2016 to $22.9 billion, due largely to lower auction results. The U.K market dropped 12% over the year to $12 billion, in part due to the drop in the pound’s value. In China, sales also fell but by 2%, to reach $11.5 billion in total.

3.

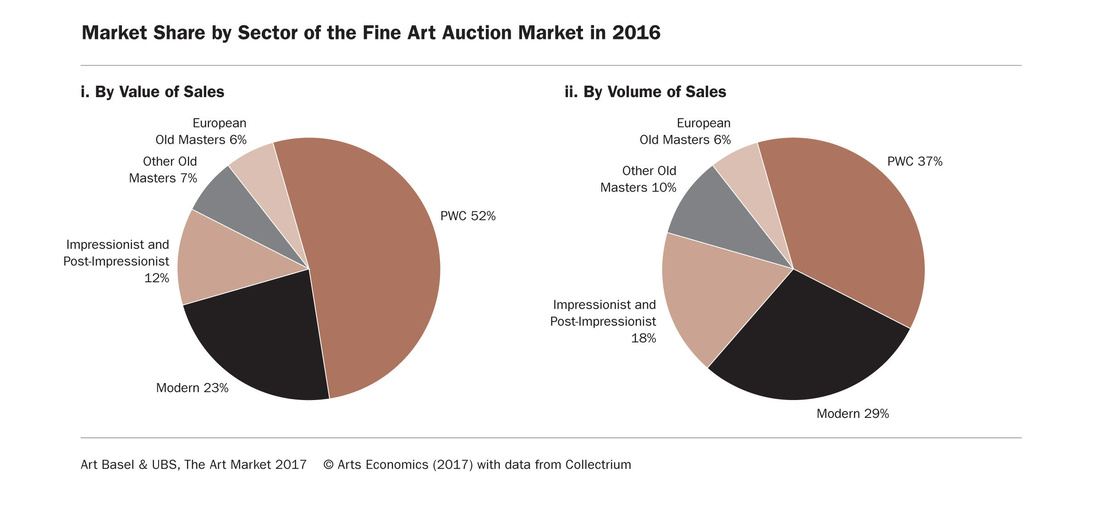

The post-war and contemporary sector, while still the largest sector of the fine art market at a 52% share, saw an 18% drop in sales in 2016 to $5.6 billion, in its second straight year of declines. Modern art had an even steeper fall of 43% to $2.6 billion, but still held 23% market share. Impressionist and Post-Impressionist art had a rough year too, falling 31%. Old Master sales were a bright spot, rising 5% to $1.4 billion in 2016.

4.

The report found a 3% rise in private dealer sales against a background of political and economic uncertainty over the course of the year. That’s consistent with anecdotal evidence, such as the sale of a Gustav Klimtpainting for $150 million by television host Oprah Winfrey to an Asian collector, and also echoes the findings of the TEFAF report released earlier in March and conducted by finance professor Rachel Pownall. That, combined with a 26% drop in public auction sales values, upped the share of the dealer market to 57% from 53% in 2015.

5.

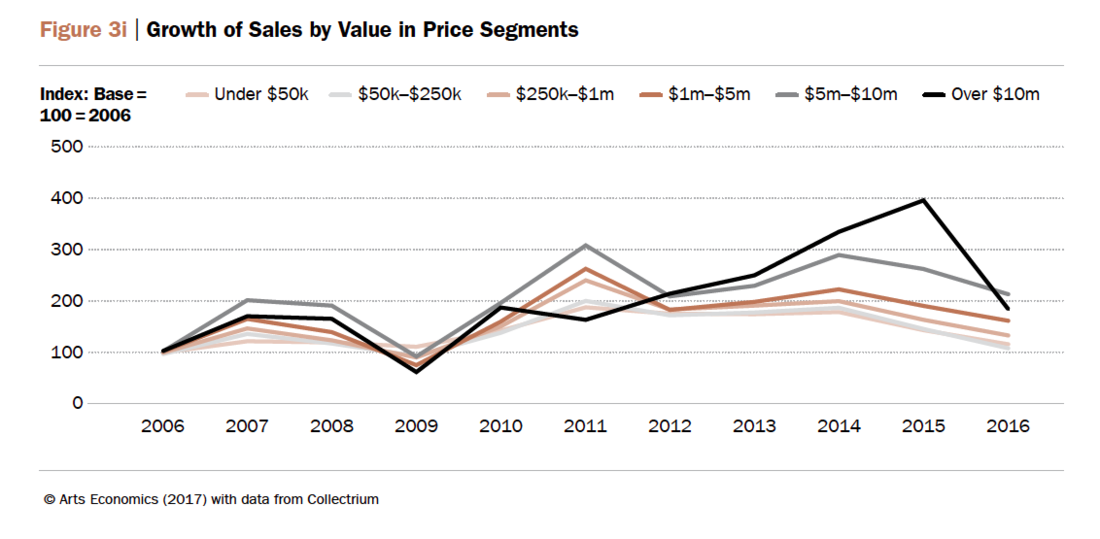

In 2016, the ultra-high end of the auction market had the steepest fall, as economic and political uncertainty kept the most coveted pieces off the public market. Auction sales values over $10 million fell 53% from 2015, while the low end fell 25% and the middle 20%. The broader high end of the market, works of $1 million or above, declined 34% over the year.

6.

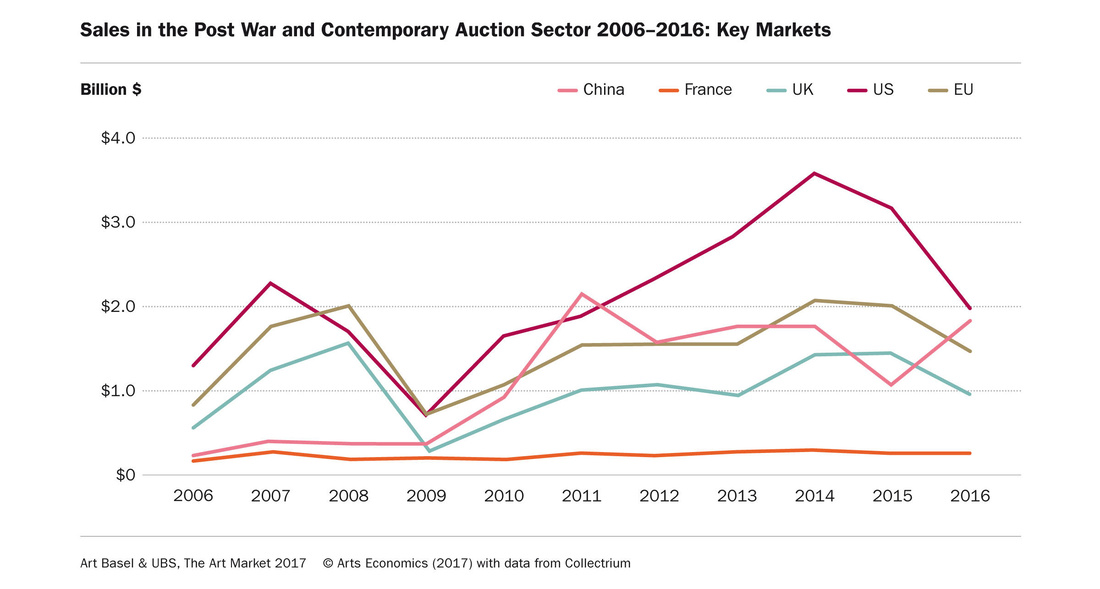

In the post-war and contemporary sector, the U.S. maintained its status as the largest center for sales, but its global share dropped 11 percentage points to 36%, while China posted a 17% gain to become the second-largest market, with 33% of sales. The U.K. lost three percentage points to claim 18% of market share, and France came in fourth with 5%.

7.

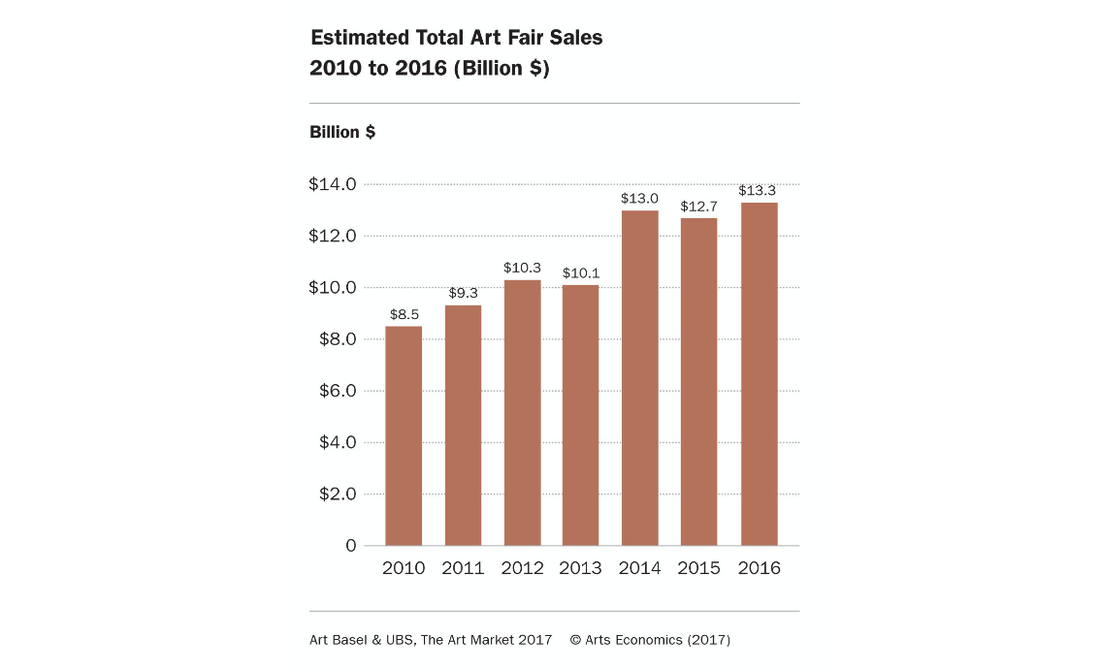

Total estimated sales at art fairs reached $13.3 billion in 2016, an increase of 5% from the prior year and up 57% since 2010. The share of dealers’ sales at international fairs rose 7% in 2016, while sales at local fairs fell 6%. But art fair costs are rising too, a burden that falls on all dealers, not just the ones whose sales are up. Fairs were the largest area of dealer spending in 2016, representing 22% of their total costs, or $4 billion, up 6% from 2015. That was followed by marketing, at 20%. The fastest-growing area of expenditures was on IT, which soared 85% from 2015 to $2.3 billion.

8.

The report said a conservative estimate of online art and antique sales in 2016 was $4.9 billion, or nearly 9% of global trade. Even as the overall fine art and antique market slid 11% over the year, online sales advanced 4%, a relatively strong result.

9.

The global art and antiques trade consisted of over 310,000 businesses employing an estimated 3 million people. The vast majority, or 2.7 million, were in the dealer and gallery sector, while just under 287,000 were employed in the auction sector. The global art trade also spent about $18 billion in 2016 on ancillary services, supporting additional jobs. The industry is relatively balanced in terms of employment by gender, and as a whole its workers boast high levels of education.

10.

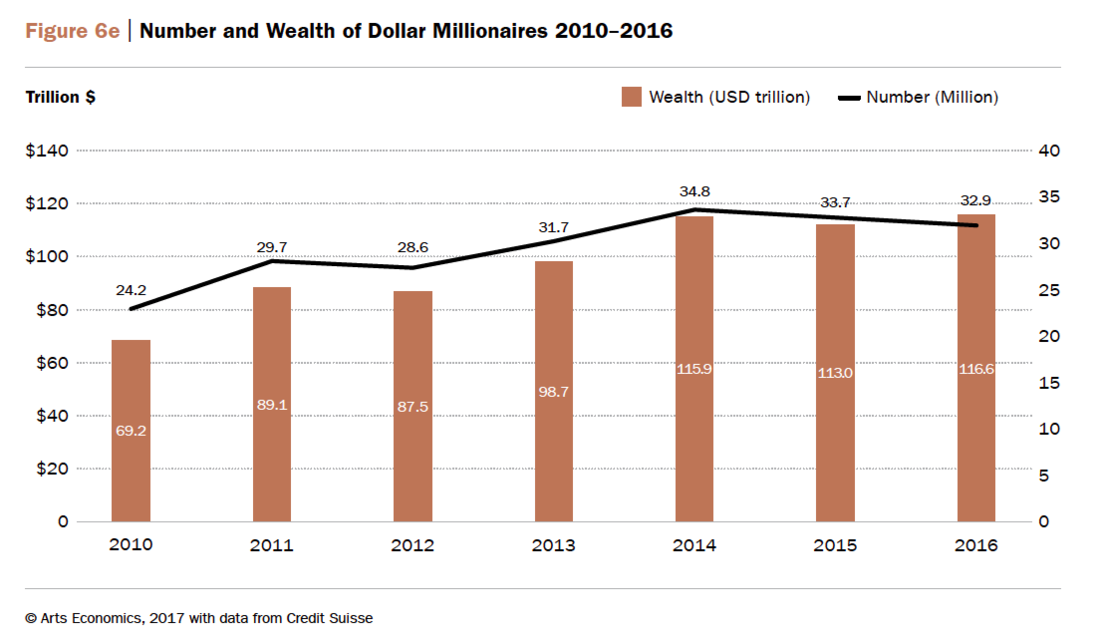

The five largest art markets (the U.S., the U.K., China, France, and Germany) contain 63% of the world’s population of millionaires, who number an estimated 32.9 million in total. Japan’s currency appreciation pushed its citizens’ net worth up in 2016, putting them at second place in share of millionaires, while the U.K.’s share fell by 15% thanks to a drop in the value of the pound. Brazil and Russia lost a number of high-net-worth individuals thanks to their shaky economies in 2016.

11.

Asia became the largest region for high-net-worth individuals in 2016, as wealth in the Asia-Pacific region grew 10% to reach $17.4 trillion, overtaking North America (at $16.6 trillion) for the first time. No surprise the art market wants to pivot to Asia.

—Anna Louie Sussman

No comments:

Post a Comment