|

|

| |||||||||

|

The golden age

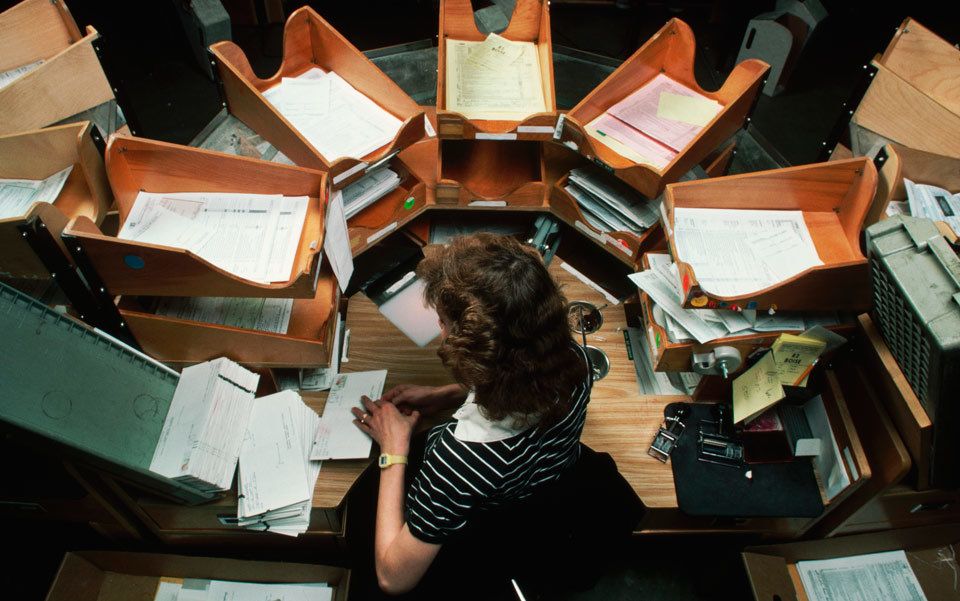

The 15-hour working week predicted by Keynes may soon be within our grasp – but are we ready for freedom from toil?

Leisure society: tourists at the Tahiti Motel swimming pool in Wildwood, New Jersey, 1960s. Photo by Aladdin Color, Inc/Corbis

I first became an economist in the early 1970s, at a time when revolutionary change still seemed like an imminent possibility and when utopian ideas were everywhere, exemplified by the Situationist slogan of 1968: ‘Be realistic. Demand the impossible.’ Preferring to think in terms of the possible I was much influenced by an essay called ‘Economic Possibilities for our Grandchildren,’ written in 1930 by John Maynard Keynes, the great economist whose ideas still dominated economic policymaking at the time.

Like the rest of Keynes’s work, the essay ceased to be discussed very much during the decades of free-market liberalism that led up to the global financial crisis of 2007 and the ensuing depression, through which most of the developed world is still struggling. And, also like the rest of Keynes’s work, this essay has enjoyed a revival of interest in recent years, promoted most notably by the Keynes biographer Robert Skidelsky and his son Edward.

The Skidelskys have revived Keynes’s case for leisure, in the sense of time free to use as we please, as opposed to idleness. As they point out, their argument draws on a tradition that goes back to the ancients. But Keynes offered something quite new: the idea that leisure could be an option for all, not merely for an aristocratic minority.

Writing at a time of deep economic depression, Keynes argued that technological progress offered the path to a bright future. In the long run, he said, humanity could solve the economic problem of scarcity and do away with the need to work in order to live. That in turn implied that we would be free to discard ‘all kinds of social customs and economic practices, affecting the distribution of wealth and of economic rewards and penalties, which we now maintain at all costs, however distasteful and unjust they may be in themselves, because they are tremendously useful in promoting the accumulation of capital’.

Keynes was drawing on a long tradition but offering a new twist. The idea of a utopian golden age in which abundance replaces scarcity and the world is no longer ruled by money has always been with us. What was new in Keynes was the idea that technological progress might make utopia a reality rather than merely a vision.

Traditionally, the golden age was located in the past. In the Christian world, it was the Garden of Eden before the Fall, when Adam was cursed to earn his bread with the sweat of his brow, and Eve to bring forth her children in sorrow. The absence of any discussion of the feasibility of an actual golden age was unsurprising. As Keynes observed in his essay, ‘From the earliest times of which we have record — back, say, to 2,000 years before Christ — down to the beginning of the 18th century, there was no very great change in the standard of life of the average man living in the civilised centres of the earth’. The vast majority of people lived lives of hard labour on the edge of subsistence, and had always done so. No feasible political change seemed likely to alter this reality.

It was only with the Industrial Revolution, and the Enlightenment that preceded it, that the idea of a future golden age, realised as a result of human action, began to seem possible. By the end of the 18th century incomes had risen to the point where radical thinkers such as William Godwin could propose that, with a just distribution of wealth, everyone could live well.

The novel idea of progress — that the natural tendency of human affairs was to get better rather than worse — became part of ‘common sense’

Such dangerous speculation led to the first and still the most notable defence of the inevitability of scarcity, Malthus’s ‘Essay on the Principle of Population’, written specifically to refute Godwin. Malthus argued that, even if a technological innovation or redistribution of wealth could improve the living standards of the masses, the result would simply be to allow more children to survive. Inevitably, the exponential growth of population would outstrip linear growth in the means of subsistence. In a short time, the poor would be poor once again.

In the initial presentation of his argument, Malthus admitted only two checks on population — misery and vice. Misery meant poverty and hunger. Vice meant contraception, to which Malthus, unlike his neo-Malthusian successors, was resolutely opposed. Although he later admitted the third option of ‘moral restraint’ (that is, sexual abstinence), he was comfortably assured that this would never be sufficient to undermine his argument. Thus he concluded that the maintenance of a small upper class (clergymen, for example), with leisure to preserve, extend and transmit culture, was the best that humanity could hope for.

The conditions of the early 19th century seemed to support Malthus’s case. The Industrial Revolution had produced an intensification of work that was almost unparalleled in human history. Driven off the land by enclosure acts and population growth, former peasants and agricultural labourers became the first industrial proletariat. The factories in which they worked rapidly drove old traders and cottage industries like that of the handloom weavers into destitution and then into oblivion.

Unconstrained by seasons or by the length of the day, working hours reached an all-time peak, with the number of hours worked estimated at over 3,200 per year — a working week of more than 60 hours, with no holidays or time off. There were small increases in material consumption, but not nearly enough to offset the growth in the duration and intensity of work.

Most economists of Malthus’s time agreed with him. All the standard models ended in a steady state, with the majority of the population at subsistence. The only important exception was Karl Marx, for whom the process of immiseration ended, not with a subsistence-level steady state, but with crisis and revolution.

By the late 19th century, things had changed. On the one hand, Malthus’s predictions were being falsified in practice. A growing middle class was enjoying improved living standards as a result of technological progress. And, whether through moral restraint or contraception, they were having smaller families. The relatively novel idea of progress — that the natural tendency of human affairs was to get better rather than worse — rapidly became part of ‘common sense’.

The working class had more compelling reasons to hope for better things. Over decades of struggle, workers clawed back the ground they had lost and then some. The Factory Acts outlawed child labour in Britain, and by 1870 all children in England and Wales were entitled to at least an elementary education. The hours of work were limited by legislation and union action. The eight-hour day, a norm that is still under challenge 150 years later, was first achieved by Melbourne stonemasons in 1855, though it was not established more generally, even in Australia, until the early 20th century. The weekend, making Saturday as well as Sunday a day of leisure, came even later, around the middle of the 20th century in most developed countries.

The idea that a combination of technological progress and political reform could produce a genuine utopia became an appealing alternative to the ‘pie in the sky’ of an afterlife. Edward Bellamy’s Looking Backward (1888), a critique of 19th century capitalism written from the imagined perspective of the year 2000, was the archetypal example of this literature. Oscar Wilde’s ‘The Soul of Man under Socialism’ (1891) was perhaps the most appealing. Even Marx, sternest critic of the old utopians, had his moments, most notably in The German Ideology (1846). There, he and Engels looked forward to a society in which labour did not depend on the lash of monetary incentives:

For as soon as the distribution of labour comes into being, each man has a particular, exclusive sphere of activity, which is forced upon him and from which he cannot escape. He is a hunter, a fisherman, a herdsman, or a critical critic, and must remain so if he does not want to lose his means of livelihood; while in communist society, where nobody has one exclusive sphere of activity but each can become accomplished in any branch he wishes, society regulates the general production and thus makes it possible for me to do one thing today and another tomorrow, to hunt in the morning, fish in the afternoon, rear cattle in the evening, criticise after dinner, just as I have a mind, without ever becoming hunter, fisherman, herdsman or critic.

None of these writers, however, had a theory of economic growth. Neither was one to be found in the literature of classical economics. Keynes’s discussion of economic possibilities was one of the first to spell out the argument that improvements in living standards, based on a combination of technological progress and capital accumulation, might be expected to continue indefinitely.

He argued that technological progress at a rate of two per cent per year would be sufficient to multiply our productive capacity nearly eightfold in the space of a century. Allowing for a doubling of output per person, that would be consistent with a reduction of working hours to 15 hours a week or even less. This, Keynes thought, would be sufficient to satisfy the ‘old Adam’ in us who needs work in order to be contented.

Keynes himself had no grandchildren, but he was a contemporary of my own grandparents. It seemed to me when I first read his essay that there was a good chance that his vision might be realised in my lifetime. The social democratic welfare state, supported by Keynesian macroeconomic management, had already smoothed many of the sharp edges of economic life. The ever-present threat that we might be reduced to poverty by unemployment, illness or old age had disappeared from the lives of most people in developed countries. It wasn’t even a memory for the young.

There was, it seemed, every reason to expect further progress towards Keynes’s vision. Working hours were decreasing. A comfortable retirement at or before 65 had become a normal expectation. The idea of a lengthy and fairly leisurely university education was increasingly accepted, even if access to higher education was far from universal. More generally, in a labour market where the number of vacancies routinely exceeded the number of jobseekers, responding to economic ‘rewards and penalties’ seemed much less urgent. If one job was unsatisfying or boring, it was a simple matter to quit, take some time off and then find another.

In these favourable conditions, anti-materialist attitudes that had been confined to a Bloomsbury elite in Keynes’s day became widespread, particularly among the young. The enthusiastic consumerism of the 1950s was repudiated in varying degrees by nearly everyone, a trend exemplified by the adoption of blue jeans, previously the cheap and durable everyday wear of unskilled workers. The idea of ‘the environment’ as a problem of more general concern than specific local issues such as air pollution and the preservation of national parks was also a product of the ’60s, book-ended by Rachel Carson’s Silent Spring (1962) and the first Earth Day in 1970. The idea that we could continue on a path of ever-growing material consumption appeared to be not merely unsatisfying but a recipe for ultimate catastrophe.

So on a first reading, ‘Economic Possibilities for our Grandchildren’ seemed prophetic. Yet, 40 or so years later, I am a grandparent myself, the year 2030 is rapidly approaching, and Keynes’s vision seems further from reality than ever. At least in the English-speaking world, the seemingly inevitable progress towards shorter working hours has halted. For many workers it has gone into reverse.

The situation in Europe was, until recently, very different. Germany’s work hours declined from 2,387 hours annually in 1950 to 1,408 in 2010. France’s declined from 2,241 hours annually in 1950 to 1,552 in 2010. Yet even here, and even before the advent of austerity, there were signs of a turnaround. The loi Aubry, the law which reduced the normal French working week to 35 hours, has been repeatedly weakened. Work-sharing in Germany was highly successful in reducing the impact of the global financial crisis, but that does not seem to have had much effect on German judgments about the desirability of more and harder work for other countries.

Moreover, far from fading into irrelevance, the struggle to accumulate capital and maintain or increase consumption is more intense than ever. Instead of contracting, the values of the market have penetrated ever further into every aspect of our lives. During the decades leading up to the global financial crisis, the scope and scale of speculative markets grew beyond any conceivable bound. Avarice and usury, as Keynes called them, are worshipped on an unimaginable scale. Financial instruments with notional values in the trillions were routinely traded, creating immense wealth for some (mostly participants in the trade) while bringing ruin and destitution to others (mostly far removed from the scene of the action).

Particularly during the ’90s, it seemed that this wealth was there to be taken by anyone willing to focus their thoughts on financial enrichment at the expense of any broader goals in life. Now that the bubble has burst, the burden of unsustainable debt left behind for both households and governments has ensured that the gods of the marketplace maintain their pre-eminence, even if their worship is much less enthusiastic than before.

How did this reversal come about, and is there any possibility that Keynes’s vision will be realised?

The first of these questions is easily answered. The economic turmoil of the ’70s put an end to the utopianism of the ’60s, and resulted in the resurgence of a hard-edged version of capitalism, variously referred to as neoliberalism, Thatcherism and the Washington Consensus. I have used the more neutral term ‘market liberalism’ to describe this set of ideas.

Social democracy must offer more than a lever to stabilise the economy. We need a vision of a genuinely better society

The central theoretical tenet of market liberalism is the efficient (financial) markets hypothesis. In the strong form that is most relevant to policy decisions, the hypothesis states that the prices determined in markets for financial assets such as shares, bonds and their various derivatives are the best possible estimates of the value of those assets.

In the core ideology of market liberalism, the efficient markets hypothesis is combined with the claim that the best way to achieve prosperity for all is to let the rich get richer. This claim is rarely spelt out explicitly by its advocates, so it is best known by its derisive label, the ‘trickle down’ hypothesis.

Taken together, the efficient markets hypothesis and the trickle down hypothesis lead us in the opposite direction to the one envisaged by Keynes. If these hypotheses are true, the mega-fortunes piled up in speculative financial markets are not merely justified: they are essential to achieve and maintain decent living standards for the rest of us. The investments that generate technological progress will, on this view, only be made if they are guided by financial markets driven by the desire to make unimaginable fortunes.

As long as market liberalism rules, there is no reason to expect progress towards a less money-driven society. The global financial crisis and the subsequent long recession have fatally discredited its ideas. Nevertheless, the reflexes and assumptions developed under market liberalism continue to dominate the thinking of politicians and opinion leaders. In my book, Zombie Economics (2010), I describe how these dead, or rather undead, ideas have risen from their graves to do yet more damage. In particular, after a resurgence of interest in Keynes’s macroeconomic theory, the entrenched interests and ideas of the era of market liberalism have regained control, pushing disastrous policies of ‘austerity’ and yet more structural ‘reform’ on free-market lines. Social democratic parties have failed to put up any serious resistance so far. Popular anger at the crisis has been channelled into right-wing tribalist movements such as the Tea Party in the US and Golden Dawn in Greece.

This experience makes it clear that, if Keynesian social democracy is to regain the dominant position it held from the end of Keynes’s own lifetime until the ’70s, it must offer more than a technocratic lever to stabilise the economy. We need a vision of a genuinely better society. For this reason, the time is right to re-examine Keynes’s vision of a future where economic scarcity, real or perceived, no longer dominates life as it does today.

To begin with, it is important to consider the limitations of Keynes’s thinking. First, Keynes considered only the developed world, implicitly assuming that the colonialist world order could be sustained indefinitely. Judging from his other writing, including his early work on the Indian economy, Keynes envisaged a gradual increase in living standards, under colonial tutelage, for the poor countries. The idea that a post-scarcity society in Europe and its settler offshoots could coexist with mass poverty elsewhere seems incongruous now, but in 1930, the European empires seemed destined to endure for a long time. The Indian National Congress had declared its goal of independence only the previous year, and the Statute of Westminster, establishing the legislative independence of the settler dominions, was a year in the future.

Once we try to apply Keynes’s reasoning to the world as a whole, it’s clear that the end of scarcity is further away than he supposed. How much further? To be more precise, how much technological progress would be needed for everyone to enjoy the average standard of living of Britain in 1930 (when Keynes was writing) by working only 15 hours a week?

For the first time in history, our productive capacity is such that no one need be poor

By 1990, 60 years after Keynes’s essay, average income for the world as a whole had just reached Britain’s level in 1930. So, it seems we need to add another 60 years, or two generations, to his timescale. On the other hand, because developing countries are mostly adopting existing technology, the average world growth rate of income per person is around three per cent, not the two per cent proposed by Keynes. In that case, an eightfold increase would take only 70 years. So, taking the entire world into account only defers the estimated end of scarcity by 30 years, to 2060 — within the expected lifetime of my children.

The problem of distribution, sharp enough in the Britain of the ’30s, is far worse for the world as a whole. A billion or so people live in destitution, and billions more are poor by any reasonable standard. Nevertheless, for the first time in history, our productive capacity is such that no one need be poor. In fact, more people are rich, by any reasonable historical standard, than are poor.

Even more strikingly, perhaps, more people are obese than are undernourished. And this is not true merely in terms of basic nutrition. Right now, the world produces enough meat to give everyone a diet comparable to the average Japanese person’s. This amount could be increased by replacing grain-fed beef with chicken and pork, a step that would also reduce carbon emissions. With another 50 years of technological progress and even a modest effort to aid the poorest onto the path of rapid growth already being followed by most of Asia, poverty could be eliminated. The vast majority of the world’s population could enjoy a living standard comparable, in material terms, to that of the global middle class of today.

A second problem to which Keynes pays only passing attention is that of housework. As a male academic born into a household staffed with domestic servants, he almost certainly did none himself. His discussion reflects this. Looking forward to the problems that might arise in a society with unaccustomed leisure, Keynes mentions ‘the wives of the well-to-do classes’ who ‘cannot find it sufficiently amusing, when deprived of the spur of economic necessity, to cook and clean and mend, yet are quite unable to find anything more amusing’. These traditional tasks had not, of course, been eliminated by technological progress. Rather, they had been contracted out to others, typified by the charwoman in a song quoted by Keynes, whose hope for paradise was to do nothing for all eternity.

Some housework is enjoyable and fulfilling but much of it is drudgery. A central requirement for a post-scarcity society is that no one should have to spend a lot of time on the latter.

The household appliances that first came into widespread use in the ’50s (washing machines, vacuum cleaners, dishwashers and so on) eliminated a huge amount of housework, much of it pure drudgery. By contrast, technological progress for the next 40 years or so was limited. Arguably, the only significant innovation in this period was the microwave oven. As a result, housework alone takes up all of Keynes’ proposed 15 hours a week. Time-use surveys suggest that the average woman in the UK spends around three hours a day on household work (excluding childcare, of which more later) and the average man spends about two hours. Both of these numbers have declined over time, but only slowly.

Market alternatives to most kinds of housework are available. Cooking can be replaced by eating out, washing and ironing can be sent out to a laundry, and (low-paid) workers can be hired to clean houses. Obviously, while people are being paid to do the housework of others, we are a long distance from Keynes’s post-scarcity world. A little less obviously, such a situation demands more time spent in paid work from those who want the money to buy market alternatives.

We might be willing to support surfers in return for non-market contributions to society

Still, the time spent on housework has been falling, and there are good reasons to think that it can fall further, to the point where most housework is done by choice rather than necessity. The rise of the internet and the advent of mobile telephony have drastically simplified a wide range of household chores, from banking and bill-paying to dealing with tradespeople. At the same time, the online world is changing shopping from a necessity to an optional extra, pursued only by those who enjoy it. It allows the requirements for a decent life to be met without any significant interaction with the culture of consumption, exemplified by the shopping mall.

An even more important omission in Keynes’s essay is the effort involved in raising children. Childless himself, Keynes came from a social class in which child rearing was contracted out, to an extent unparalleled before or since. Babies were handed to wet-nurses, cared for by nannies and governesses and then, from the age of eight or even younger, packed off to boarding schools. From the perspective of today’s parents, such a world is hard to imagine. Even if the need for market work were to disappear altogether, parents of young children would not have much time to worry about the need to fill their leisure hours.

But far from weakening Keynes’s case against a money-driven society, the problems of caring for children illustrate the way in which our current economic order fails to deliver a good life, even for the groups who are doing relatively well in economic terms. The workplace structures that define a successful career today require the most labour from ‘prime-age’ workers aged between 25 and 50, the stage when the demands of caring for children are greatest.

Work is distributed unequally, and perversely, in other dimensions as well. And yet, in the English-speaking countries at least, this has not meant more leisure so much as more time in retirement, unemployment or otherwise involuntarily excluded from the labour force. The result has been an inequality of leisure, the counterpart to the growing inequality of income. Particularly in the US, families are becoming polarised. On the one hand there is the two-income class of economically successful couple households in which both partners work full-time or more. On the other is the zero-income class, with one or two adults dependent either on welfare benefits or else on intermittent and insecure low-wage employment.

If work was distributed more equally, both between households and over time, we could all be better off. But it seems impossible to achieve this without a substantial reduction in the centrality of market work to the achievement of a good life, and without a substantial reduction in the total hours of work.

The first step would be to go back to the social democratic agenda associated with postwar Keynesianism. Although that agenda has largely been on hold during the decades of market-liberal dominance, the key institutions of the welfare state have remained both popular and resilient, as shown by the wave of popular resistance to cuts imposed in the name of austerity.

Key elements of the social democratic agenda include a guaranteed minimum income, more generous parental leave, and expanded provision of health, education and other social services. The gradual implementation of this agenda would not bring us to the utopia envisaged by Keynes — among other things, those services would require the labour of teachers, doctors, nurses, and other workers. But it would produce a society in which even those who did not work, whether by choice or incapacity, could enjoy a decent, if modest, lifestyle, and where the benefits of technological progress were devoted to improving the quality of life rather than providing more material goods and services. A society with these priorities would allocate most investment according to judgments of social need rather than market signals of price and profit. That in turn would reduce the need for a large and highly rewarded financial sector, even in relation to private investment.

There remains the question of how to move from a revitalised social democracy to the kind of utopia envisaged by Keynes. It would be absurd to spell out a detailed transitional program, but it’s useful to think about one of the central elements of such a society — a guaranteed minimum income.

In one sense, a guaranteed minimum income involves little more than a re-labelling of the existing benefits provided by all modern welfare states (with the US, as always, a notable exception). In most modern welfare states, everyone is eligible for income support which should be sufficient to prevent them from falling into poverty. Those who cannot work because of age or disability are automatically entitled to such support, while unemployed workers receive either insurance benefits related to their previous wages or some basic allowance conditional on job search.

In a post-scarcity society, everyone would be guaranteed an income that yielded a standard of living significantly better than poverty, and this guarantee would be unconditional. The move from a near-poverty benefit subject to eligibility conditions to a liveable, guaranteed minimum income would require both an increase in productivity, such that a smaller number of workers could produce an adequate income for all, and some fairly radical changes in social attitudes.

It seems clear enough that technological progress can generate the necessary productivity gains, so what is needed most is a change in attitudes to work that would make a guaranteed minimum income socially sustainable. The first is that the production of market goods and services needs to become pleasant enough that those doing it don’t mind supporting others who choose not to. The second is that the option of receiving a guaranteed minimum income does not become a trap, leading into the kind of idleness that produces despair.

We can imagine a few steps towards this goal. One would be to allow recipients of the minimum income to choose voluntary work as an alternative to job search. In many countries, a lot of the required structures are in placed under ‘workfare’ or ‘work for the dole’ schemes. All that would be needed is to replace the punitive and coercive aspects of these schemes with positive inducements. A further step would be to allow a focus on cultural or sporting endeavours, whether or not those endeavours involve achieving the levels of performance that currently attract (sometimes lavish) public and market support.

An Australian example might help to illustrate the point. Under our current economic structures, someone who makes and sells surfboards can earn a good income, as can someone good enough to join the professional surfing circuit. But a person who just wants to surf is condemned, rightly enough under our current social relations, as a parasitic drain on society. With less need for anyone to work long hours at unpleasant jobs, we might be more willing to support surfers in return for non-market contributions to society such as membership of a surf life-saving club. Ultimately, people would be free to choose how best to contribute ‘according to their abilities’ and receive from society enough to meet at least their basic needs.

We do have the technological capacity to start down that path and to approach the goal within the lives of our grandchildren. That’s a couple of generations behind Keynes’s optimistic projection, but still a hope that could counter the current tides of cynicism and despair.

This brings us to the final, really big question. Supposing a Keynesian utopia is feasible, will we want it? Or will we prefer to keep chasing after money to buy more and better things?

In 2008, 16 economists contributed to an interesting volume called Revisiting Keynes, edited by Lorenzo Pecchi and Gustavo Piga. Many of those economists argued that Keynes had been proved wrong. Experience, they said, had shown that people will always want to consume more and will be willing to work harder to do it. Implicit in much of their discussion was the idea that the US economy, as of 2008, represented the way of the future. With the advantage of a few years’ hindsight, this assumption seems every bit as dubious as the view against which Keynes argued in 1930, that the Depression would continue indefinitely.

The steady growth in consumption expenditure in the US in the decades leading up to the financial crisis depended on debt. And of course, the need to service debt necessitated a willingness to work long hours. Now, after millions of foreclosures and bankruptcies, a large proportion of the population has been excluded from credit markets. Households in general have seen the need to build up their savings.

More importantly, the culture of conspicuous consumption, which reached unparalleled heights of excess in the 1990s and early 2000s, is on the wane. The most striking emblem of this change is the end of the American love affair with the motor car. Throughout the 20th century the car stood in American culture as a symbol of personal freedom attainable through consumption expenditure. Year after year, pausing only briefly for recessions and slowdowns, more and more cars were driven further and further, burning more and more petrol. But this endless growth has now, apparently, come to an end. The use of petrol in the US peaked in 2005, before the advent of the economic crisis. The distance driven has also peaked and Americans are buying fewer and smaller cars. Economic factors, including higher fuel prices, have a role to play. But anecdotal evidence suggests that there is more to it than this. Increasingly, driving is seen as an unpleasant chore rather than an exercise of freedom. Young people in particular have been less eager than their parents to start driving and acquire cars.

Such shifts bring bigger changes in their wake. Without cars and commuting, large houses in the suburbs are much less attractive. After decades of steady growth, the size of new houses seems to be declining. Smaller houses mean fewer possessions to fill them, and less appeal for a privatised life based on private consumption.

An escape from what Keynes called ‘the tunnel of economic necessity’ is still open to us. Yet it will require radical changes in the economic structures that drive the chase for money and in the attitudes shaped by a culture of consumption. After decades of finance-driven capitalism, it takes an effort to recall that such changes ever seemed possible.

Yet it is now clear that market liberalism has failed in its own terms. It promised that if markets were set free, everyone would benefit in the long run. In reality, most households in developed countries experienced less income growth under market liberalism than in the decades of Keynesian social democracy after 1945. Of more immediate importance, except for the top one per cent there has been no recovery from the crisis of 2008, and even worse looms ahead. And despite the initial success of the backlash against Keynesian macroeconomic policies, austerity is now failing in political as well as economic terms.

Popular anger has boiled over in a string of electoral defeats for the advocates of austerity. But, unlike the right-wing tribalism that has formed part of that backlash, progressive politics cannot, in the end, rely on anger. It must offer the hope of a better life. That means reclaiming utopian visions such as that of Keynes.

No comments:

Post a Comment