In October, the night after the Mets’ season ended, the bright lights of Citi Field flickered back on again as a handful of players — the former All-Stars Jose Reyes, Jeurys Familia and David Wright among them — returned to the field one more time.

Except these Mets weren’t there to play baseball. They signed autographs, posed for pictures and schmoozed with the guests of honor: real estate officials who had rented out the ballpark. Children took batting practice; real estate executives roamed the outfield; the Jumbotron flashed photos of the crowd using the hashtag #AmTrustTitleDreamTeam.

And New York home buyers picked up the tab, at least indirectly.

The extravagant evening was just one night of entertainment in the title insurance industry, an obscure corner of the real estate world that has spent tens of millions of dollars to win the favor and business of its clients at ballparks, Madison Square Garden luxury suites, exclusive country clubs, expensive steakhouses, even strip clubs.

All that spending has been baked into the title insurance rates that New Yorkers seldom scrutinize in the stressful rush to complete a closing, which state regulators say are hundreds, sometimes thousands of dollars higher than in neighboring states like Connecticut, Massachusetts and New Jersey.

Adam R. Rose, vice chairman of Rose Associates, a major New York real estate developer and owner, likened it to “state-sponsored corruption and money-laundering in developing countries.”

ADVERTISEMENT

“The egregiousness of title insurance in New York State is something that inflates premiums to fund lavish entertainment, and it’s easily combated,” Mr. Rose said.

Nine months ago, New York officials proposed a fix: a complete ban on such expenses. The new rule has drawn praise from consumer advocates, Gov. Andrew M. Cuomo and even some business leaders. It is set to go into force on Thursday.

But in Albany, industry opponents are pushing back hard. Lawmakers, perhaps feeling the effect of a $400,000 lobbying campaign in 2017, have urged state regulators to delay or rewrite the looming gift ban. And the chairmen of the powerful insurance committees in the State Senate and Assembly are backing legislation that would undercut the new rule.

Maria Vullo, who heads the New York State Department of Financial Services, which has adopted the new regulations, told lawmakers this month that such legislation would amount to a “license to commit bribery.”

She was ignored. Days later, the State Senate took up its bill to undercut the new rule. It passed, without debate, in less than two minutes. The vote was unanimous.

“The legislators, instead of saying, ‘Oh, good for consumers,’ they’re saying, ‘My God — oh, the poor industry,’” said J. Robert Hunter, director of insurance for the Consumer Federation of America.

Not every state is like this. In Iowa, for instance, the state government took over the title business decades ago, and it charges a fraction of the price in New York: $110 for a residential purchase up to $500,000, according to the state.

The price for title insurance on a $500,000 home in or near New York City, with 20 percent down, is around $2,700.

Title insurance in New York is a particularly peculiar market. Customers are typically required to buy it to guarantee clear ownership of their property. But most rely on real estate agents or attorneys to decide which title insurance to buy, because all the biggest companies charge the exact same regulator-approved price. (Two upstart firms charge lower rates.)

So how do title companies here stand out? For years, industry veterans said, it’s been by dangling an array of perks for real estate developers and other mortgage-industry insiders.

“This industry more than any other lives and dies by providing entertainment,” said Jonathan Miller, the president and chief executive of Miller Samuel, a real estate appraisal and consulting firm. “Everybody has the same price. Yeah, their logos are different. But the way that you differentiate is by providing entertainment.”

Mr. Hunter, who studied the data from a New York title insurance investigation from 2008 to 2012, said “improper expenses” in those years amounted to $79.5 million — roughly 6.3 percent of premiums.

Robert Treuber, executive director of New York State Land Title Association, argues that Ms. Vullo’s proposal — which would ban expenses as small as buying a client a cup of coffee — overreaches. He broadly defended the industry’s expenses as necessary business development, and said title companies are following rules and rates set by the state. “They’re spending their profit to grow their business,” he said.

The gold-plated expense accounts in the title industry have rarely been publicly detailed. In the late 1990s, a lawsuit against one title insurance salesman revealed the breadth of his wining and dining: $150,000 in reimbursements in 1997 alone, including Broadway shows, “exclusive club memberships” and sports tickets.

One title agency, Riverside Abstract, is known for its lavish holiday partiesthat lure more than 1,000 people to open bars, carving stations, hand-rolled cigars and fine food. “A better way to close is our motto and I guess better parties as well,” Yoel Zagelbaum, president of Riverside Abstract, is quoted saying in one company document that promoted its 2015 soiree. The company, whose marketing expenses are under investigation by the financial services department, did not respond to requests for comment.

The industry-backed legislation advancing in Albany would narrow the entertainment prohibition to more explicit “quid pro quo” gifts — the direct exchange of tickets or meals for particular business. Entertaining in luxury boxes or handing out gift cards to designer stores without such an explicit connection would thus be considered legal.

Current law already prohibits using entertainment as “an inducement” for business. The debate between Ms. Vullo and the title insurance industry is what exactly “inducement” means.

“There’s no reason to do the tickets unless you’re ‘inducing’ business,” she said.

She gave the example of one title firm, which she declined to name, that spent “$5.4 million for tickets, just tickets” in 2008, plus another $120,000 on country club dues and $833,000 on meals. The company collected $30.9 million in premiums that year — meaning more than 18 percent of its revenue was spent on entertainment.

“I’m protecting home buyers,” Ms. Vullo said of the new rule, which would immediately slash title insurance rates in the state by 5 percent. (Companies could avoid that cut by opening their books to the state to show their entertainment expenses amounted to less than that.) “I’m trying to reduce closing costs.”

But Mr. Treuber and lawmakers have asked, if the current expenses are so outrageous, why hasn’t Ms. Vullo cracked down on any of the supposed bad actors, like the firms she found visiting strip clubs?

“Sure, some may be able to point to some sensational incident or two, but let’s not harm the entire industry,” said Senator James L. Seward, the Republican chairman of the insurance committee, who wrote the bill that passed unanimously.

“If it’s illegal, prosecute,” Kevin A. Cahill, a Democrat who is chairman of the Assembly’s insurance committee, said of Ms. Vullo. “If it’s not illegal, come to the Legislature and let’s make it illegal.”

The expense ban had originally been set to go into effect in mid-December but was postponed to Feb. 1 after legislators asked for time to examine it. They’ve pushed for a six-month delay; Ms. Vullo has resisted. Alphonso David, counsel to Mr. Cuomo, said the governor’s office was leaving the timing up to the financial services department but that, “We support these regulations in concept.”

Title insurance companies have marshaled a half-dozen lobbying firms to make their case, including big Albany players like Brown & Weinraub, Ostroff Associates and Jackson Lewis. Hank Sheinkopf, a longtime Democratic strategist, was paid $90,000 by a title company last year, and George Haggerty, a former top official in the Department of Financial Services, earned more than $100,000 from two title companies. Richard Bamberger, a former communications director for Mr. Cuomo, is providing messaging assistance.

One company, AmTrust Financial Services, which, along with a subsidiary, First Nationwide Title Agency, hosted the Citi Field event in October, opened a political action committee in New York and quickly raised more than $100,000. Another, State Street Title Agency, gave Mr. Cuomo $50,000 in December.

Some title insurance executives are political players in their own right. Steven M. Napolitano, president of First Nationwide, has given New York politicians nearly $475,000 since 2006. Another $222,000 came from Carnap L.L.C., which is listed at Mr. Napolitano’s home address.

The Mets declined to comment on the cost of renting out the stadium. A spokesman for AmTrust, Hunter Hoffmann, said that “thousands of prospective and current clients were invited” to the event, and about 600 commercial real estate professionals did attend.

“From our perspective, it was a cost-effective event to communicate and connect with our clients,” he said, adding that it was in “full compliance with the regulations at the time.”

First Nationwide is known for its hospitality. The company logo has been affixed to the wall of a Madison Square Garden suite in recent years, according to social media posts. And last year, the company’s marketing team invited clients to watch the A.C.C. college basketball tournament at a “luxury suite” at the Barclays Center. “Contact your FNT sales representative to secure your seat!” said an invitation obtained by The New York Times.

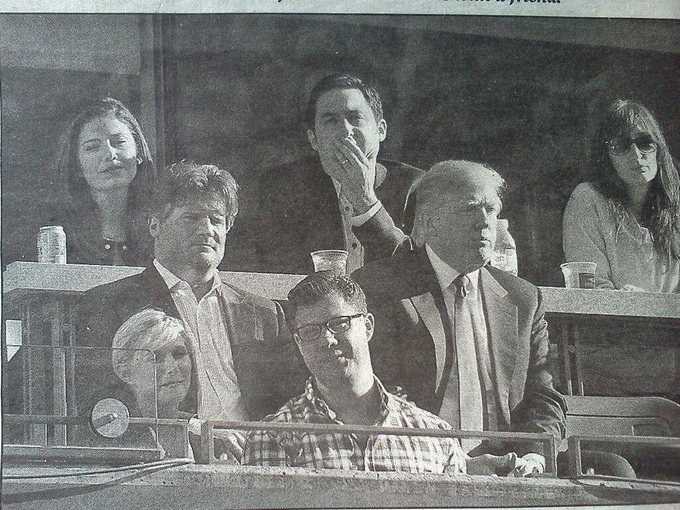

Back in 2012, one of the firm’s first tweets featured a company executive sitting with the then-New York developer Donald J. Trump at what appears to be a sporting event, urging its executives to “get out there and build those relationships!”

“We believe these activities are an efficient method of maintaining communications with our large commercial real estate clients, which are represented by some of the most sophisticated and prestigious law firms and real estate investors in the world,” Mr. Hoffmann said.

Mr. Napolitiano declined to comment. Mr. Hoffmann noted that Mr. Napolitano had “no significant political activity in the past year beyond support of his local elected officials” and that his giving is allowed.

Mr. Treuber said the gift rule, when combined with new caps on fees that title companies can charge, could cost jobs in an industry that employs thousands.

“If we can solve this problem through talking with D.F.S., if we can get relief through legislative measures, that would be great. If going to litigation is necessary, then that’s an option that we’ll have to consider,” he said.

Mr. Treuber’s association has retained a major law firm, Gibson Dunn, as they consider suing, and is raising hundreds of thousands of dollars to cover the potential legal bills.

For now, the title insurance parties are rolling on.

At a real estate gala in mid-January, AmTrust Title hosted three open bars across two ballrooms in Midtown Manhattan, as hundreds of real estate officials mingled between bites of tuna tartare and fresh mint mojitos that came with a stirrer with AmTrust’s logo on it. A few blocks away, at the upscale restaurant Nobu 57, an after-party co-sponsored by at least one title agency, Royal Abstract, currently under state investigation for its expenses, kept the cocktails flowing and sushi rolling through midnight.

No comments:

Post a Comment