What’s in store for L.A.’s cannabis market in 2023? A roller-coaster ride for starters

What can SoCal cannabis consumers expect to see happening in the legal weed market in 2023? What forces are shaping the local landscape? What products are in the pipeline? What surprises are coming down the pike? To find out, a handful of California-based industry power players weighed in.

The consensus? The fifth year of the Golden State’s legal recreational cannabis market is going to see some things disappear, specifically smaller businesses and product offerings from dispensary shelves, and at least one thing — old-school hash — reappear.

“Cannabis has always been a roller coaster, and I think it’s going to be a little turbulent in 2023,” said Gilbert Milam Jr. (better known as Berner), co-founder and chief executive of San Francisco-based global cannabis brand Cookies.

Here are six predictions for L.A.'s cannabis industry for 2023.

1. Consolidation likely to continue and accelerate

One of the top trends of 2022 was a shakeout in the California cannabis industry — closures, consolidations and mergers and acquisitions. And all those surveyed about the 2023 landscape expect that trend to continue — if not accelerate. “I think you’re going to see a lot of consolidation,” said Berner. “A lot of people have jumped into cannabis who didn’t really understand the business. They [just] kind of saw the gold rush aspect and they have a lot of assets, and those assets aren’t performing as well as they’d like them to.”

Troy Datcher, chief executive of Jay-Z-backed, San Jose-based the Parent Co., feels the same way. “I think it’s going to be a really tough environment for most operators,” Datcher said, citing the lack of regulatory movement at the federal level in 2022, specifically the failed efforts at passing any cannabis-related banking measures. “Especially for small operators without access to capital.” (That’s a result of the plant’s illegal status federally.)

“I actually think [the consolidation] will accelerate,” said Chad Bronstein, co-founder, president and chairman of the Tyson 2.0 cannabis brand, who also cited the impact of the drug’s federal status. “Even [without passing] the SAFE Banking Act, even if they’d just removed 280E, businesses would have been in much better shape,” he said, referring to the section of the Internal Revenue Service code that prohibits writing off business expenses for cannabis businesses.

“Last year was a tough year psychologically for California cannabis businesses,” said Caroline Yeh, co-founder and chief executive of TSUMo Snacks, a San Francisco-based maker of THC-infused savory snacks. “And this year is going to be a tough year financially.” Yeh based her assessment on several factors including a historic oversupply of cannabis, the state’s high taxes and challenging regulations.

“Someone at a smaller brand I know said that you can buy [cannabis] flower for $300 a pound now, and it costs more than that to grow it, process it, package it and put it on the shelf,” she said. “So what’s the point? You’re just creating a net loss at that point. So that company decided to shut down.” Yeh said those are the kinds of distressed companies that will be ripe for mergers and acquisitions in the coming months.

2. A looming deadline for social equity applicants

Kika Keith, chief executive and founder of the Crenshaw Boulevard dispensary Gorilla Rx Wellness and longtime activist on behalf of the city’s social equity licensees, pointed to another regulatory factor that will profoundly shape the Los Angeles cannabis landscape in the coming year: the end of provisional state licensing, which will make it more challenging for equity applicants to open their doors and start generating revenue.

“You talk about consolidation and people closing their doors ... there are people who are still trying to open their doors,” she said, explaining that local equity applicants who haven’t filed an application for a provisional license with the state by a March 31 deadline will instead have to apply for an annual license the requirements for which are much more costly and time-consuming. And with only about 60 of L.A’s 305 equity dispensary licensees fully up and running, Keith predicts the year ahead will be shaped as much by the businesses that never appear as by the ones that disappear. (Currently, once a provisional license is applied for, the clock starts ticking and applicants have three months — with a possible three-month extension — to complete a temporary approval application with the city, which requires, among other things, securing a location.)

“In just going through the red tape of licensing, a lot of folks have had to renegotiate with their investors because it ended up being so long, and now they don’t have the money to open their stores and [are] having to get new investors. And I definitely think we’re going to see a bloodbath for 2023,” Keith said. “The grim reality is we’ve waited so long for equity to totally be in full swing. It’s a big barrier. … [State] Sen. Bradford introduced SB 51 that pushes to extend [provisional licensing] for equity [applicants] but, as it stands, it’s really bad news.”

3. Shrinking product choices

The same conditions shrinking the number of players in the market will also result in fewer products on dispensary shelves. “A lot of retailers will cut the number of SKUs [or stock keeping units] they carry and the number of brands they carry,” Yeh said. “So what you’ll see is fewer offerings and more of the higher-performing items.” Likewise, she said, brands will pull back distribution efforts. “Last year, we were focused on growth and [growing] awareness, and that succeeded for us. This year we’re following the 80/20 rule: focusing 80% of our effort on the top-performing 20% of dispensaries.”

This survivor-mode mentality, as Yeh described it, will also result in fewer new products hitting the market. “You’re not going to see products released at the rate they were [previously],” she said. “There were SKUs I was thinking about releasing into the market this year, but investing in releasing products is actually an expensive thing to do. And, to be cash conscious, I have to say, ‘Well, OK, maybe we don’t do that this year.’”

4. An emphasis on new and different

Despite the market contracting, consumers in the maturing recreational cannabis market likely will be on the hunt for things that are new and different, and brands will try to deliver. “I think people want to explore new things,” Keith said. “I think for a minute, everything was so brand-centric. But now people are just about, ‘Is the weed good?’ They’re just asking their budtender what’s good.”

Berner echoed that sentiment. “What I’m looking for — and what I noticed other brands looking for — is something different, something unique.” He thinks some of that newness could come in what flavor profiles consumers gravitate toward. (“Right now it’s all about [the] Purple Terps [cultivar], but I think the OG stanky gas [flavor profile] is going to make a comeback,” he said.)

That hunt for the unique is also why Berner said Cookies is launching a line of cannabis flower grown on-site and only available at a single Cookies dispensary in Maywood. “We’re going to dial in this microbrewery kind of concept and have an exclusive menu that has been curated and hand-selected, things that I’ve smoked personally and signed off on, batch by batch.”

On the edibles front, Yeh predicts a move to cater to culturally diverse palates. “One of the trends from the last few years is cannabis brands and entrepreneurs getting better at putting out flavors that are reflective of their own ethnicities,” she said, pointing to companies such as La Familia, an L.A. company that makes infused chocolate bars in flavors including Horchata Hot Chocolate and Fresas Con Crema, and Potli, maker of Cannabis-Infused Shrimp Chips. ”What I love about those shrimp chips is, if you’re an Asian person who grew up with those products, you can look at that package and be like ‘Oh, I know this product. I grew up with this,’” Yeh said.

“I think you’re going to see that trend continue in the edibles space where there’s a certain consumer you’re targeting, you’re not aiming for mass appeal,” she said. “I think that will be particularly strong in Los Angeles where you have this multi-ethnic community, high immigration rates and all these shops and restaurants.”

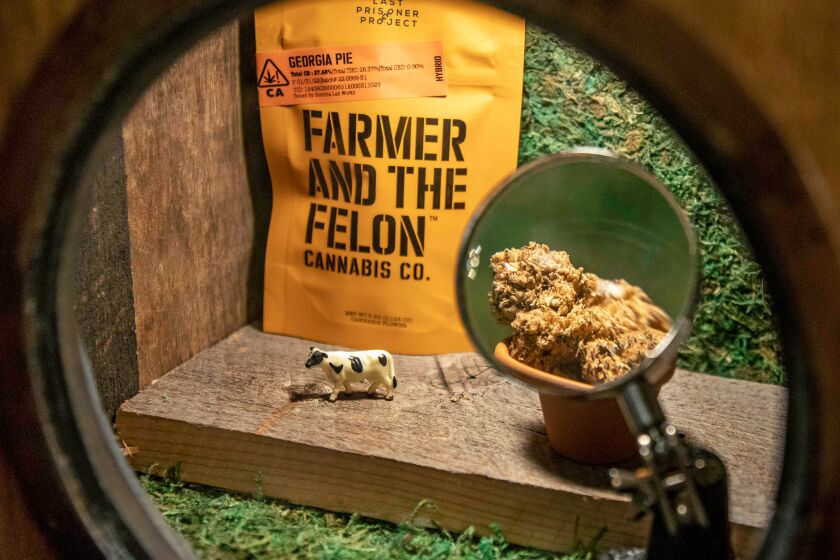

5. Hash’s moment

One of the hot new things on the horizon may be something that’s actually been around for thousands of years. “I think hash is going to be huge in 2023,” Berner said, referring to the concentrated form of cannabis made by separating the sticky THC-containing part from the rest of the plant. “Maybe I’m being a little biased because I’m obsessed with it right now, but it’s all I really enjoy smoking. … I really want to get into that market. I think 2023 is going to be about hash — hash collaborations between different brands as well as new hash products.”

Roger Volodarsky, founder and chief executive of L.A.-based Puffco, a company that caters specifically to the cannabis concentrate crowd (its flagship product is a sleek upscale vaporizer called the Peak), agrees. “We believe that 2023 is the year that people will start to love hash more than they ever have. ... There are a lot of variables to that. One is the [ongoing] normalization of concentrates in the United States. The other is the concentrates market. I hear from my personal hashmaking friends that the hash market is expected to bottom out.” Volodarsky said wider acceptance combined with lower prices, which he believes consumers should start to see by the middle of 2023, bodes well for a boom.

6. Celebrity brand challenges

Over the last several years, the ranks of celebrity-affiliated weed brands has swelled to head-scratching absurdity (famous folks in the weed game at the end of 2022 included “Family Matters” actor Jaleel White, former pro wrestler Ric Flair and actress Bella Thorne) as a way of quickly and easily turning existing fan bases and social media followings into potential customers. Now, some think that the era of the celebrity cannabis brand may be heading toward a saturation point.

“I think we’re already there,” Keith said, explaining that instead of pursuing traditional consumer product marketing techniques, many brands jumped on the celebrity bandwagon as a way getting in front of eyeballs. “They come with the celebrities and they think that that’s going to make people want to buy it,” she said. “And it works for that moment when [the celebrities] are in store and hyping it up and all of their fans come out. But then after that, it’s just about the weed.”

Berner, himself a successful product of the celebrity weed-branding machine (before he helmed a worldwide weed brand he made a name for himself as a Bay Area rapper), said it’s not simply a license to print money.

“I think the problem with celebrity brands is a lot of them don’t understand the industry,” he said. “So they get in, drop a strain, get excited, and then there’s no money. And then they get unexcited. I think if it’s an organic situation, and there’s real [cannabis plant] genetics behind it and there’s purpose behind it, and [if] the celebrity understands what kind of business this is, it can work. But if they’ve just jumped into it for the gold rush, I think you’ll see celebrity brands come and go.”

But not everyone believes celebrity cannabis branding will peak in 2023. Chief among the evangelists is Tyson 2.0’s Bronstein, whose stable of celebrity brands include not only Mike Tyson’s but partnerships with Ric Flair and Evander Holyfield that launched in 2022 and an upcoming partnership with what he calls a “well-known national icon” that will be announced in the not-too-distant future.

“I disagree,” he said about the waning power of the celebrity brand. “I’ve always said what makes a celebrity brand successful is how invested they are in it. It’s not like the beauty business. [The celebrity] needs to be involved in the day-to-day. Consumers are picky, and there needs to be a reason they’re buying.”

The Parent Co.'s Datcher is another one who’s still bullish on the celebrity cannabis partnerships. “There’s a lot of folks who crap on the celebrity brands,” he said. “However, I do think this is the year of the influencer. … If you [partner] with the right influencer and the product is authentically integrated into their life, I think there’s a tremendous amount of opportunity to connect your brand to [their] followers.” Such relationships remain important, he said, because many of the traditional avenues of generating brand awareness aren’t available due to the plant’s illegality at the federal level.

“That’s why we’re excited about our restructured relationship with Roc Nation,” he said, referring to the New York-based entertainment agency founded in 2008 by Jay-Z. “And having an ability to tap into their artists, which has always been part of the conversation with Jay and the team.”

Senior features writer Adam Tschorn writes about a range of style-centric pop-culture topics for the Los Angeles Times. Holding a B.A. in philosophy and an M.A. in journalism makes him well-qualified to look at something and ask: “Why?”